E-Invoicing in Saudi Arabia: Impact for Travel Agents and How Nucore can help them to get prepared towards Phase1 rollout on Dec 4th 2021

What is E-invoicing

To begin with, electronic invoicing is a process that converts paper invoices into electronic invoices. The new procedure allows processing and exchanging invoices, credit notes, etc., into a structured electronic document format. The buyer and the seller share the documents through this process.

Why is Saudi Arabia implementing E-invoicing?

Let us look at why Saudi Arabia is implementing electronic invoices? They are

- Increasing transparency

- Reducing the shadow economy

- Increasing tax obligations

- Increase efficiencies in payments and tax process

Who is required to adhere to E-invoicing in Saudi Arabia?

The people/entities that need to adhere to E-invoicing are a) All taxable people in Saudi Arabia (The Residents), b)Third parties issuing invoices on behalf of taxpayers subject to VAT, c) Businesses that do any type of transactions.

Now that we have looked at the overview of e-invoicing let us discuss how Saudi Arabia will implement e-invoicing?

At the outset, e-bills, e-debits, and e-credits are issued and are saved in electronic formats. The formats must contain all the tax invoice fields.

The taxpayers’ systems will then interconnect with the Zakat, Taxes and Customs Authority (ZATCA). This interconnectivity will enable the data to be transmitted.

The E-invoicing rollout is in two phases. The first phase will be enforced from 4th December 2021 with a simplified scope. The second phase will be enforced from 1st January 2023. The roll out for the people to be included in the tax bracket will be implemented in phases. Not all the taxpayers will come on to phase 2 at the same time. The taxpayers will be given n adequate time of around six months as advance notice.

In Phase 1, the mandatory requirements are:

- People will have to move out of manual invoices and move into an electronic invoice solution.

- The invoices must include the buyer’s VAT number on the invoice when the buyer is VAT registered.

- The people should add a QR code to the E-invoice (whether it is B2C or B2B)

- There are no mandated formats to use. However, people can use the pre-approved official Phase 2 format earlier and integrate with the authority earlier. There are no requirements in Phase 1 for the solution provider to be certified by the administration.

- Your invoices must be approved by the tax administration so that they can exchange them between the trading parties. Reporting of the invoices follows this phase.

ZATCA recommends that taxpayers check whether they are subject to the E-invoicing regulation as a first step. The taxpayers must also save their e-bills from being able to meet the minimal requirements.

Companies now need to address how they can implement the relevant technologies. The companies need to prepare for compliant formats for E-invoicing over the next 12 months.

They must also meet specific minimum pertinent requirements to e-invoicing issuance. These include:

- Access to the internet

- Control of data, information, or cybersecurity

- Tamper protection

- Ensuring the exchange with API via external systems

How will the billing practices of any organization change from Dec 4th

- Persons who generate invoices should generate e-invoices through compliant electronic systems

- The electronic invoices should have the ability to create QR codes.

- The design should not support the prohibited functions as prescribed by ZATCA

- It should be updated constantly by mirroring the policies specified on ZATCA website.

Next steps

As a first step, you must ensure that the E-invoicing regulations apply. You should also ensure that any other party is issuing tax invoices on behalf of a supplier in your ecosystem.

Following this, you must conduct an impact assessment of the new E-invoicing rules and their readiness. It would be best if you did the following reviews:

- Make the relevant systems in your organization compliant with the E-invoicing regulations

- Identify the transactions in your business that will have to be compliant with the E-invoicing regulations

- Integrate your enterprise applications with the E-invoicing systems

Figure out the data exchange with the ZATCA systems in the Arabic language

How to check your system is compliant to the new rule?

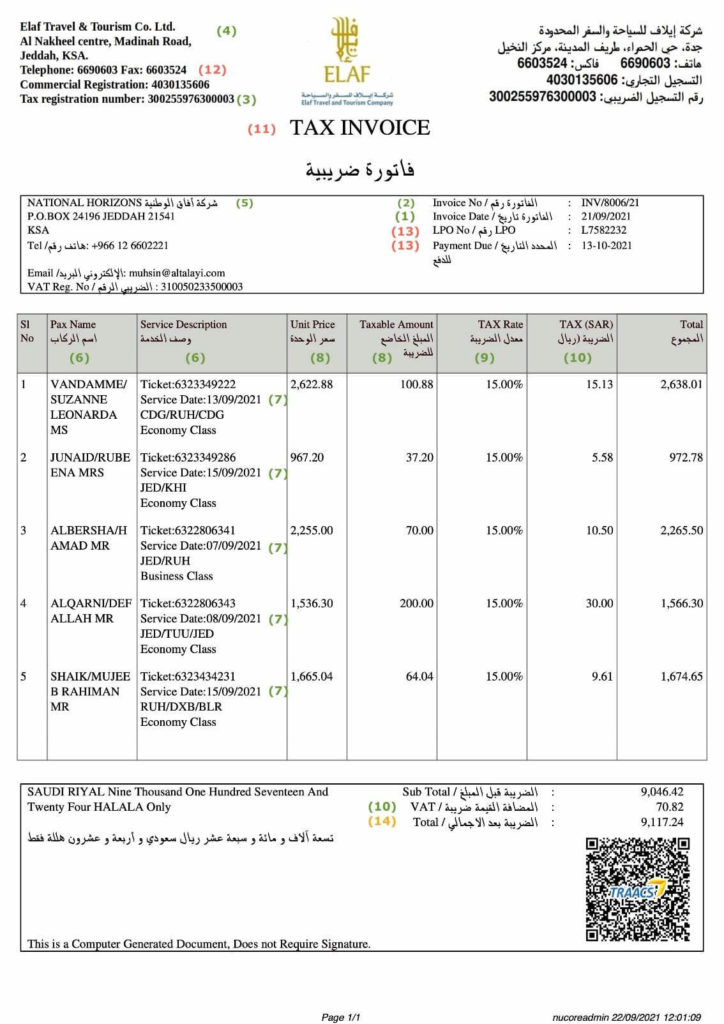

As per ZATCA guidelines, standard Tax Invoice should have following mandatory & other common information printed in the Invoice

- Date of Invoice generated

- Sequential Invoice Number

- Travel Agency Tax Identification Number

- Travel Agency Name and Address

- Customer Name and Address

- Passenger Name , Ticket Number, Route, Class etc.

- Date of Service like Ticket Issue date

- Taxable Amount & Unit Price

- Tax Rate

- Amount of VAT charged in SAR

- Document Name

- Supplier Telephone Number, Fax etc.

- Other information like supporting LPO number, Payment details etc.

- Total amount including VAT total

Below is the standard Invoice format issued by ZACTA

Now make sure your Travel accounting system is compliant with above 14 mandatory points, if not otherwise you may end up paying heavy fines after 04th December 2021.

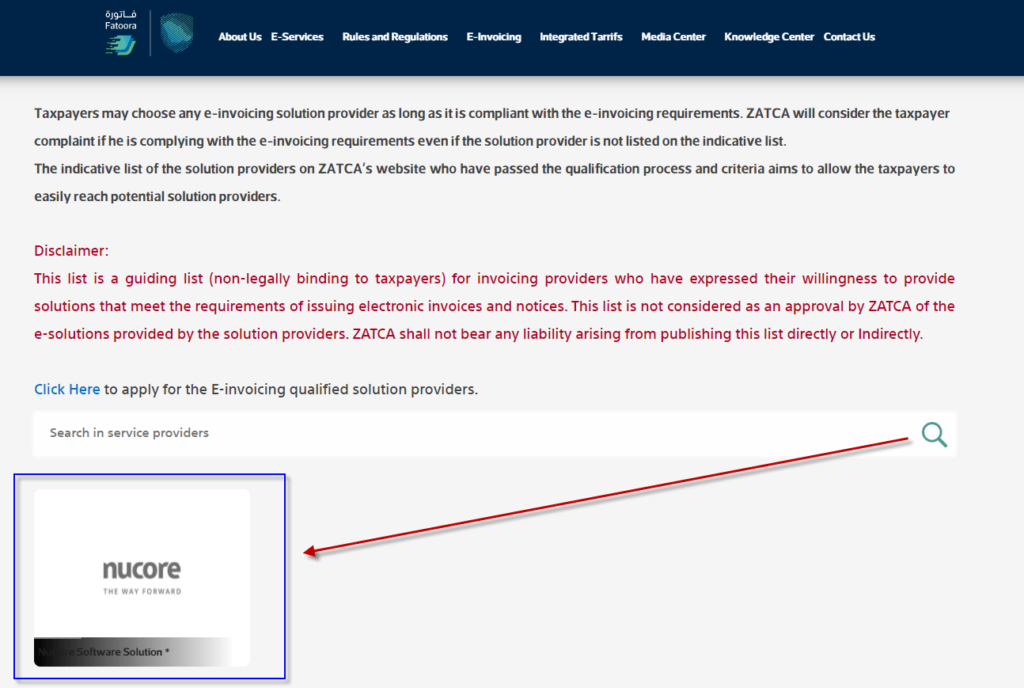

Easy method to check whether your provider is approved vendor by ZATCA

If you want to know whether your existing Accounting vendor is approved by ZATCA, here is an easy way. Click below link and check for your accounting service provider name

If your Accounting service provider is approved, it should be listed as below

How Nucore Software Solutions- Leader in Travel ERP solutions has moved ahead and implemented E-invoicing in TRAACS for its Travel Agency customers in KSA?

Nucore has been providing technical solutions to the travel industry for last 18 years. TRAACS, one of the leading Travel Accounting, Mid-Office and Financial Management Platform developed by Nucore for Travel Agencies, Online Travel Agents and Travel Management Companies. With more than 200+ satisfied Travel agency customers in KSA, TRAACS is one of the most successful back office system across Middle East & Africa.

Nucore, one of the pioneer has already implemented most of these guidelines well ahead of getting this guidelines from ZACTA. Nucore’s technical team, work closely with the Travel agency customer and implemented all these 14 points in their TAX Invoice for their customers.

Below is a sample Invoice generated from TRAACS system

As mentioned in the above invoice, each of the 14 mandatory information’s as per ZACTA guidelines are already incorporates in all the TAX invoices generated from TRAACS system.

To know more on TRAACS and E-Invoice implementation feel free to write to us at [email protected] or [email protected].